2019 Seminars

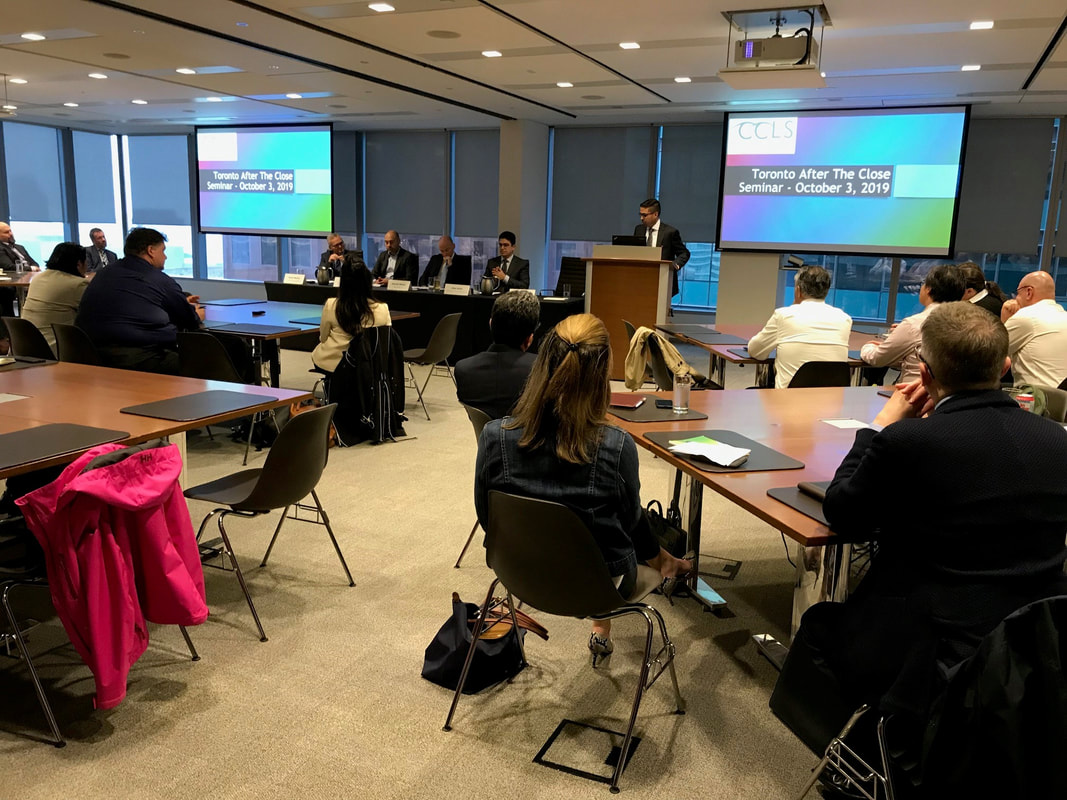

Thursday, October 3, 2019

After the Close Seminar

Market Structure and Its Impact on Best Execution

The complex market structure and ever evolving technology pose great challenges to investment dealers in achieving best execution for clients. This seminar provided a concise overview of Canadian equity market structure and how it impacts trading decisions.

Speakers:

Kevin McCoy, Vice-President, Market Policy and Trading Conduct Compliance, IIROC

Alex Perel, Director, Head of ETF Services, Scotia Capital Inc.

Darren Molloy, Director, Retail Trading, GMP Securities L.P.

Jeff Varey, VP, Wealth Management Equity Markets, RBC Dominion Securities Inc.

Moderator:

Shailesh Ambike, Director, Advisory, Global Capital Markets, Scotia Capital Inc.

After the Close Seminar

Market Structure and Its Impact on Best Execution

The complex market structure and ever evolving technology pose great challenges to investment dealers in achieving best execution for clients. This seminar provided a concise overview of Canadian equity market structure and how it impacts trading decisions.

Speakers:

Kevin McCoy, Vice-President, Market Policy and Trading Conduct Compliance, IIROC

Alex Perel, Director, Head of ETF Services, Scotia Capital Inc.

Darren Molloy, Director, Retail Trading, GMP Securities L.P.

Jeff Varey, VP, Wealth Management Equity Markets, RBC Dominion Securities Inc.

Moderator:

Shailesh Ambike, Director, Advisory, Global Capital Markets, Scotia Capital Inc.

| Market Structure And Its Impact On Best Execution.pptx | |

| File Size: | 288 kb |

| File Type: | pptx |

| ccls_education_subcommittee_accreditation_letter_-_20191003_-_en.pdf | |

| File Size: | 360 kb |

| File Type: | |

| ccls_education_subcommittee_accreditation_letter_-_20191003_-_fr.pdf | |

| File Size: | 474 kb |

| File Type: | |

June 13, 2019

Calgary Breakfast Seminar : Supervision - Advisor Compensation Conflicts

Conflict of interest issues, and how dealer members manage them, remain a top priority for the regulators. While many firms have robust oversight of basic conflict considerations such as personal trading and outside business activities, recent Business Conduct Compliance reviews of IIROC dealer members have revealed shortcomings in the management of compensation-related conflicts.

This session reviewed IIROC’s expectations and guidance, and considered best practices for management, supervision and documentation of more complex conflicts including:

Rules: IIROC Rule 42 - Conflicts of Interest

IIROC Consolidated Rule 1400 - Standards of Conduct

Notices: IIROC Notice 19-0008 IIROC Compliance Priorities

IIROC Notice 17-0093 Compensation-related Conflicts Review

Speakers:

Richard Korble, Director, Prairie Region, IIROC

Jamie Mihalicz, Director, Compliance & Supervision, ATB Securities Inc.

Govind Achyuthan, Chief Compliance Officer, Acumen Capital

Moderator:

Brian Pynn, Managing Director Compliance, ATB Wealth

Calgary Breakfast Seminar : Supervision - Advisor Compensation Conflicts

Conflict of interest issues, and how dealer members manage them, remain a top priority for the regulators. While many firms have robust oversight of basic conflict considerations such as personal trading and outside business activities, recent Business Conduct Compliance reviews of IIROC dealer members have revealed shortcomings in the management of compensation-related conflicts.

This session reviewed IIROC’s expectations and guidance, and considered best practices for management, supervision and documentation of more complex conflicts including:

- compensation programs, compensation grids, referral income and recruitment practices

- in-house sales target campaigns and bonus incentives

- non-monetary and third-party promotions and incentives

- product-related conflicts & fee-based versus transactional conflicts

Rules: IIROC Rule 42 - Conflicts of Interest

IIROC Consolidated Rule 1400 - Standards of Conduct

Notices: IIROC Notice 19-0008 IIROC Compliance Priorities

IIROC Notice 17-0093 Compensation-related Conflicts Review

Speakers:

Richard Korble, Director, Prairie Region, IIROC

Jamie Mihalicz, Director, Compliance & Supervision, ATB Securities Inc.

Govind Achyuthan, Chief Compliance Officer, Acumen Capital

Moderator:

Brian Pynn, Managing Director Compliance, ATB Wealth

| Advisor Compensation Conflicts.pptx | |

| File Size: | 264 kb |

| File Type: | pptx |

| ccls_education_subcommittee_accreditation_letter_-_20190613_-_en.pdf | |

| File Size: | 359 kb |

| File Type: | |

| ccls_education_subcommittee_accreditation_letter_-_20190613_-_fr.pdf | |

| File Size: | 477 kb |

| File Type: | |

May 15, 2019

Cannabis : Capital Markets and Business Conduct

Cannabis stocks have bloomed in Canada even before the 2018 legalization of recreational marijuana in October. Sustained high interest in Canadian pot stocks has created many opportunities for short term investors which has led to volatility and other concerns around raising capital.

The panel discussed different themes such as disclosure requirements, capital markets activities and the expectations on the compliance group on the following:

Katrina Janke, Senior Legal Counsel, Corporate Finance Branch, OSC

Eric Foster, Partner, Dentons

Jeff Meade, VP, Legal, TD Bank Group

Moderator:

John Fabello, Partner, Torys LLP

Cannabis : Capital Markets and Business Conduct

Cannabis stocks have bloomed in Canada even before the 2018 legalization of recreational marijuana in October. Sustained high interest in Canadian pot stocks has created many opportunities for short term investors which has led to volatility and other concerns around raising capital.

The panel discussed different themes such as disclosure requirements, capital markets activities and the expectations on the compliance group on the following:

- Update on cannabis issuer capital raising and trading activity in Canada

- CSA’s disclosure expectations and continuous disclosure review of reporting issuers in the cannabis industry: implications for investment banker due diligence, research analysts and suitability assessments

- Cannabis issues and stocks in litigation: class actions and M&A, and impact in retail investors

- Interaction of the Canadian cannabis market with markets outside of Canada (including US, Europe): issues impacting retail compliance and legal

Katrina Janke, Senior Legal Counsel, Corporate Finance Branch, OSC

Eric Foster, Partner, Dentons

Jeff Meade, VP, Legal, TD Bank Group

Moderator:

John Fabello, Partner, Torys LLP

| ccls_education_subcommittee_accreditation_letter_-_20190515_-_fr.pdf | |

| File Size: | 471 kb |

| File Type: | |

| ccls_education_subcommittee_accreditation_letter_-_20190515_-_en.pdf | |

| File Size: | 357 kb |

| File Type: | |

| Cannabis: Capital Markets and Business Conduct | |

| File Size: | 266 kb |

| File Type: | pptx |

| Cannabis: Capital Markets and Business Conduct | |

| File Size: | 165 kb |

| File Type: | |

February 21, 2019

Derivatives: Business Conduct and Registrations

Rules: NI 93-101 Derivatives: Business Conduct

NI 93-102 Derivatives: Registrations

Speakers:

Kevin Fine, Director, Derivatives, Ontario Securities Commission

Srijan Agrawal, Director, Regulatory Strategy and Engagement, RBC

Lisa Mantello, Partner, Osler

| CE Credit IIROC confirmation.pdf | |

| File Size: | 305 kb |

| File Type: | |

| Derivatives Registration and Business Conduct | |

| File Size: | 634 kb |

| File Type: | pptx |

| Derivatives Registration and Business Conduct | |

| File Size: | 3093 kb |

| File Type: | pptx |

| Derivatives Registration and Business Conduct | |

| File Size: | 140 kb |

| File Type: | |